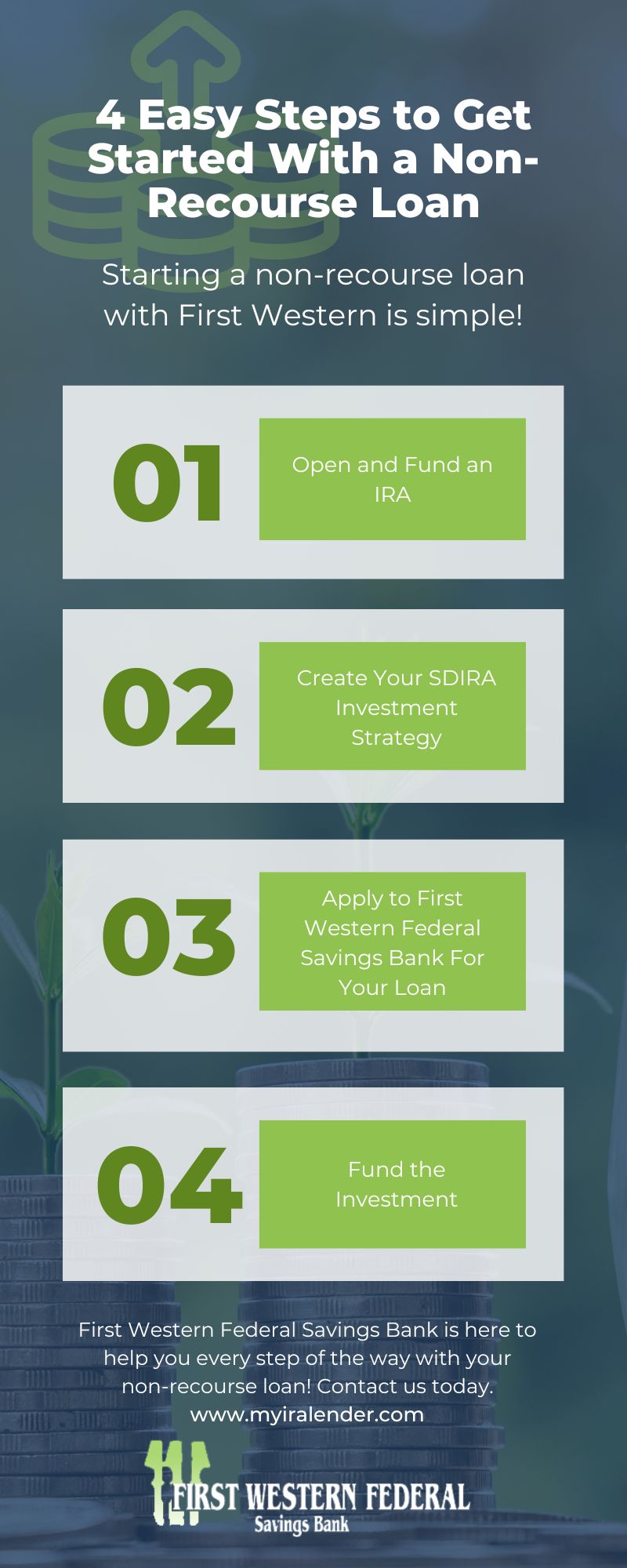

Four Easy Steps to Get Started With a Non-Recourse Loan

When you’re looking for a loan, it’s important to find the right lender. Not all lenders are created equal, and some offer more benefits than others. If you’re looking for a non-recourse loan, First Western Federal Savings Bank is the perfect place to go. We offer non-recourse loans with no personal guarantee required. In this blog post, we will discuss four easy steps to get started with a non-recourse loan from First Western Federal Savings Bank!

First of All — What is a Non-Recourse Loan?

A non-recourse loan is a secured loan that uses collateral as security. Although the issuer can seize the collateral if the borrower defaults, it cannot seek out the borrower for additional compensation, even if the collateral does not cover the entire amount of the defaulted sum. In a nutshell, lenders can get the collateral but not other possessions of the borrower.

Step 1: Open and Fund an IRA at First Western Federal Savings Bank

The first step to getting started with a non-recourse loan from First Western is to open and fund an IRA with us. This will give you access to the funds you need to secure the loan. An IRA is a retirement account that allows you to save for your future while also getting tax benefits. If you haven’t had any experience with an IRA, our team at First Western can help you get started.

Step 2: Create Your SDIRA Investment Strategy

The next step is to create your self-directed individual retirement account (SDIRA) investment strategy. This will help you determine how much money you need to invest and what type of investments you should make. You can speak with a financial advisor to get started.

Step 3: Apply to First Western Federal Savings Bank for Your Loan

The third step is to apply for your non-recourse loan from First Western Federal Savings Bank. You can do this by filling out an online application or by visiting a branch location. Once you’ve been approved, you’ll need to sign the loan agreement and provide collateral for the loan.

Step 4: Fund the Investment and Begin Repaying the Loan

The fourth and final step is to fund the investment and begin repaying the loan. You’ll make payments on the loan each month until it’s paid off. Once the loan is repaid, you’ll be able to keep the profits from your investment!

The Benefits of Non-Recourse Loans

Non-recourse loan financing provides borrowers with a number of advantages, including:

- Your personal assets are not attached to the loan in any way, so even if you default on loans, your lender can only take your collateral but not your personal belongings.

- Loans with non-recourse features allow borrowers to sell their share of the property that is backed by the non-recourse loan without fearing future obligations.

- Non-recourse loans are a wonderful alternative for individuals who are preparing for the future since they include estate planning benefits.

- Non-recourse loans are more favorable to borrowers because their personal finances aren’t at risk — there is no personal liability. The borrower is not subject to the lender’s or bank’s legal action. The borrower’s credit score is typically unaffected by this sort of non-recourse debt.

First Western Federal Savings Bank is here to help you every step of the way when it comes to getting a non-recourse loan. We offer competitive rates and terms, and our team is always available to answer any questions you may have. Contact us today to get started!