Strategies For Securing The Best IRA Loan Rates

Investing in a retirement account like those offered by First Western Federal Savings Bank is an important step in securing your financial future. A key factor in the success of any retirement savings account is the interest rate you receive. An IRA bank loan can help you maximize the rate of return on your investments, especially if you can secure the best rates possible. Here are some strategies to help you secure the best IRA loan rates.

Compare Different Rates

It pays to shop around when looking for the best IRA loan rates. The best way to find the best IRA loan rates is to compare offers from several different lenders. You can do this easily online, or you can contact a financial advisor to help you compare offers. Make sure to look at the interest rate, loan terms, and any fees associated with the loan.

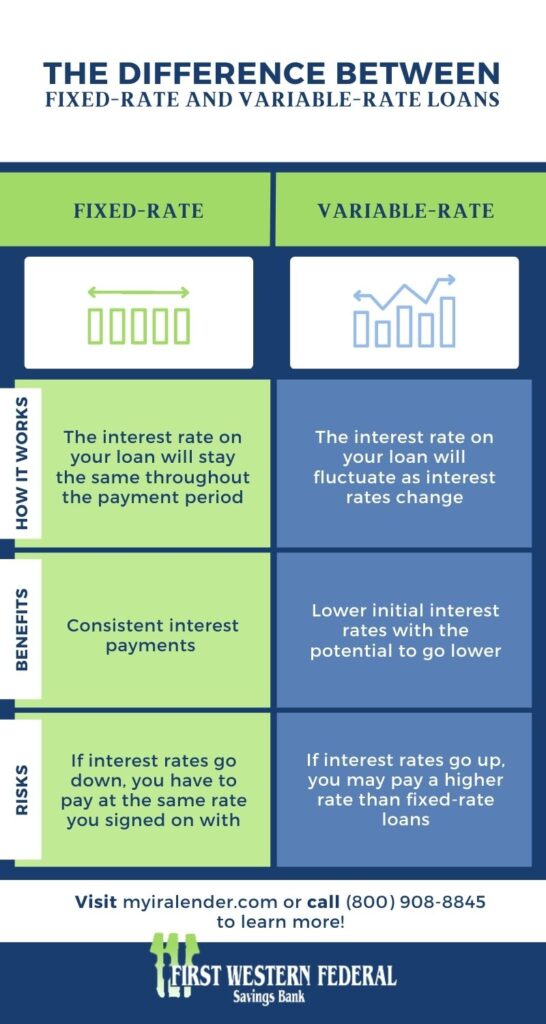

Choose Between Fixed And Variable Rate Loans

Fixed-rate loans are typically considered to be safer than variable-rate loans since the interest rate will not fluctuate with the market. This makes it easier to plan for your future payments and ensures that you’ll be paying the same amount of interest from month to month.

Meanwhile, variable-rate loans typically have lower interest rates to start off than fixed-rate loans, but their rates can adjust over time. This means that they could go up over time, and you’ll wind up paying more than the fixed rate would have been — but the inverse is possible as well. If you have a fixed-rate loan and interest rates go down, you could be stuck paying the higher price.

Working with a financial adviser may help you to figure out what the best loan for you is, by knowing the markets and being able to predict how the interest rate might change in the future.

Search Out Promotions

When looking for a bank loan to fund your IRA, be sure to check for any promotions that the lender may be offering. Many lenders offer discounted interest rates, no closing costs, or other incentives to incentivize you to take out a loan with them. Comparing loan offers and promotions can help you find the best deal when taking out a bank loan for your IRA.

Understand The Fees

Some loans may have fees associated with them, such as an origination fee, closing costs, or other charges. Make sure to understand all of the fees associated with a loan before signing on the dotted line.

Much of this information comes down to finding the right bank that offers the best rates. First Western Federal Savings Bank strives for honesty and transparency in our practices, helping you to understand every aspect of your loan and getting you all of the information you need before you sign. Call us today at (800) 908-8845 to get started!

Contact First Western